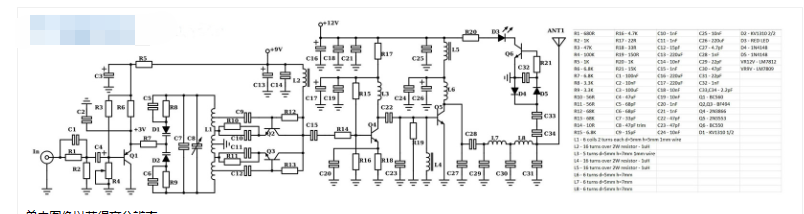

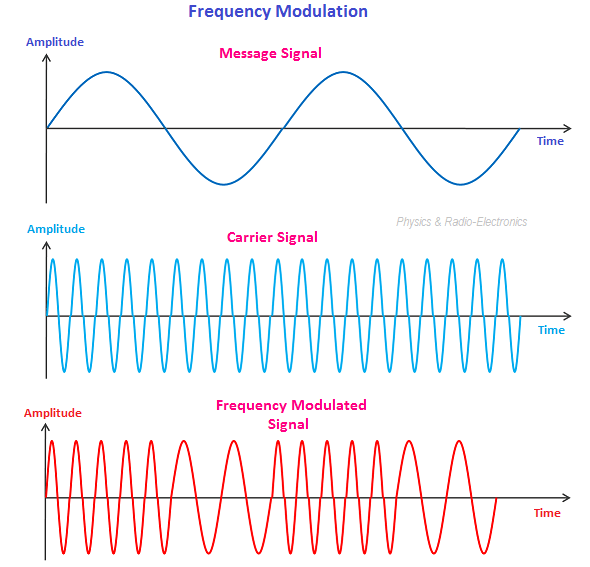

In a wireless communication system, it generally includes four parts: an antenna, a radio frequency front end, a radio frequency transceiver module, and a baseband signal processor. With the advent of the 5G era, the demand and value of antennas and RF front-ends are rising rapidly. The RF front-end is the basic component that converts digital signals into radio frequency signals, and is also the core component of wireless communication systems.

According to the function, the radio frequency front end can be divided into the transmitting end Tx and the receiving end Rx.

According to different devices, the RF front-end can be divided into power amplifier PA (radio frequency signal amplification at the transmitting end), filter filter (signal filtering at the transmitting and receiving end), low noise amplifier LNA (signal amplification at the receiving end, noise reduction), and switch (different Channel switching), duplexer (signal selection, filter matching), tuner tuner (antenna signal channel impedance matching), etc.

Popular science of various radio frequency devices

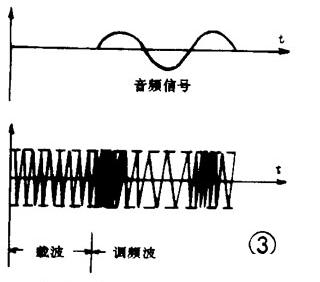

Filter Filter: select a specific frequency to filter out interference signals

Filter (Filter) is the most important discrete device in the RF front-end, which allows specific frequency components in the signal to pass through and greatly attenuates other frequency components, thereby improving the anti-interference and signal-to-noise ratio of the signal. At present, acoustic filtering technology is mainly used in the mobile phone RF market.

According to different manufacturing processes, acoustic filters on the market can be divided into two categories: surface acoustic wave filters (Surface Acoustic Wave, SAW) and bulk acoustic wave filters (Bulk Acoustic Wave, BAW). Among them, the SAW filter has a simple manufacturing process and high cost performance, and is mainly used for low-frequency filtering below GHz, while the BAW filter has low insertion loss and excellent performance, and can be applied to high-frequency filtering, but the process is complicated and the price is high.

Due to the limitations of process complexity, technology and cost, more RF front-ends use SAW filters under current communication standards. However, with the increase of 5G penetration rate, the excellent performance of BAW filter and support for high frequency will make it become the mainstream device of mobile phone RF front-end.

Duplexer/Multiplexer: Isolation of transmit/receive signals

A diplexer, also known as an antenna sharer, consists of two sets of band-stop filters with different frequencies. Using the frequency division function of high-pass, low-pass or band-pass filter, the same antenna or transmission line can use two signal paths, so as to realize the reception and transmission of two kinds of different frequency signals by the same antenna.

Power amplifier PA: amplifies radio frequency signals for transmission

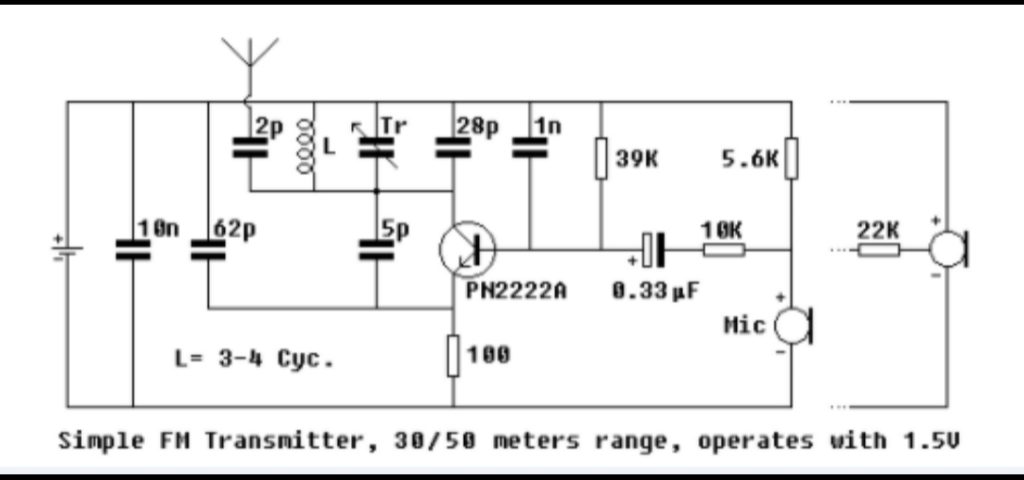

The power amplifier (PA, Power Amplifier) is the core component of the RF front-end. It uses the current control function of the triode or the voltage control function of the field effect tube to convert the power of the power supply into a current that changes according to the input signal.

PA is mainly used in the transmission link. By amplifying the weak radio frequency signal of the transmission channel, the signal can successfully obtain high enough power, so as to achieve higher communication quality, stronger battery life, and longer communication distance. The performance of the PA can directly determine the stability and strength of the communication signal.

With the continuous development of semiconductor materials, power amplifiers have also experienced three technical routes of CMOS, GaAs, and GaN. The first-generation semiconductor material is CMOS, with mature technology and stable production capacity. The second-generation semiconductor materials mainly use GaAs or SiGe, which have a higher breakdown voltage and can be used for high-power, high-frequency device applications. The third-generation semiconductor material GaN is significantly better than GaAs in performance, but the cost is higher. At present, GaAs is mainly used as the power amplifier in the mobile civilian market, and GaN is the first to replace it in some base station applications. In the future, GaN will become the main solution for high radio frequency and high power consumption applications.

Low Noise Amplifier LNA: Amplifies the received signal and reduces noise introduction

href=”https://www.yibeiic.com/”>LNA (Low Noise Amplifier) is an amplifier with a small noise figure. Its function is to amplify the weak radio frequency signal received by the antenna and minimize the noise. Introduced, the LNA can effectively improve the receiving sensitivity of the receiver, thereby increasing the transmission distance of the transceiver. Therefore, whether the design of the low noise amplifier is good or not is related to the communication quality of the entire communication system.

RF switch Switch: control circuit on and off, realize signal switching

The RF switch (Switch) realizes the switching of different signal paths by connecting any one or several control logics of multiple radio frequency signals, including the switching of receiving and transmitting, switching between different frequency bands, etc., so as to achieve shared antenna, shared Channel, the purpose of saving the cost of the end product. RF switches mainly include mobile communication conduction switches, WiFi switches, antenna tuning switches, etc.

Tuner Tuner: Antenna impedance matching

Antenna tuner (Tuner) is an impedance matching network located between the transmitting system and the antenna, which is used to realize functions such as signal reception, filtering, amplification, gain control, etc., so that the antenna radiates the maximum power on all application frequencies.

Under the 5G/Sub-6 communication standard, the 4×4 downlink MIMO on the mobile phone requires each antenna to efficiently support a wider frequency range, and accordingly the demand for radio frequency antenna tuners will also increase to improve the radiation efficiency of the corresponding frequency band .

Other RF front-end devices

Envelop Tracker (ET), that is, an envelope tracker, is used to improve the efficiency of a power amplifier carrying a signal with a high peak-to-average power ratio, and to achieve adaptive power amplification output. Compared with the average power tracking technology, the envelope tracking technology can make the power supply voltage of the power amplifier change with the envelope of the input signal, and improve the energy efficiency of the RF power amplifier.

RF Reveiver, that is, radio frequency receiver. In the radio frequency receiver, after the radio frequency signal is received by the antenna, the signal is converted and demodulated by the filter, LNA, analog-to-digital converter ADC, etc., and finally the baseband signal entering the baseband is formed. There are three main types of radio frequency receivers: superheterodyne receivers, zero-IF receivers, and near-zero-IF receivers.

In the past years of development, RF front-end materials have also experienced multiple generations of development.

Market Size and Competitive Landscape

In the past ten years, the RF front-end market has maintained a steady and rapid growth. In 2019, the market size reached US$17 billion, an increase of 269% compared to US$6.3 billion in 2011. It is estimated that the RF front-end market will reach USD 25 billion by 2025.

The RF front-end market is highly concentrated, basically monopolized by the top four major manufacturers. In 2019, Broadcom (US, 29%), Skyworks (US, 28%), Murata (Japan, 22%) respectively ) and Kovo (USA, 18%), other manufacturers accounted for only about 3%.

Among them, the filter market (53%): SAW filters are dominated by Murata, and BAW technology is basically monopolized by Broadcom and Qorvo; the power amplifier market (33%): the three major manufacturers in the United States account for 93% of the market share; switches and other components ( 10%): Skyworks and Qorvo dominate other RF device markets.

In 2019, the global sales of filters were US$9.52 billion, of which SAW was US$5.33 billion and BAW was US$4.19 billion, accounting for 41% in 2019 from 30% in 2015. In the future, with the increase of 5G penetration rate, it is expected Continued to increase.

In 2019, the sales of filters in the Chinese market were US$2.61 billion, of which SAW was US$14.6 and BAW was US$1.15 billion. Due to the large self-sufficiency gap in the domestic filter market and the fact that it is at the end of the 4G-5G switchover, the market size has experienced negative growth, which has decreased by US$ 240 million compared with 2015. In the future, with the improvement of localization rate and the increase of 5G mobile + base station penetration, it is expected to rebound quickly.

The filter industry is technology- and capital-intensive, and requires extremely high design experience and patent layout. With the patent competition and fierce mergers and acquisitions since the 21st century, the radio frequency end of mobile phones has gradually formed a pattern in which Japanese and American manufacturers monopolize the SAW and BAW markets respectively.

Broadcom and Murata occupy the high-end market as the first camp with years of technology accumulation and patent layout; Skyworks, Qorvo, TDK, TaiyoYuden, etc. occupy the mid-end market with comprehensive technology and supporting modules as the second camp; Korea, Taiwan and China are currently the third camp with Focus on the low-end market, and strive to penetrate into the mid-to-high-end market.

SAW: Japanese manufacturers led by Murata, TDK and Taiyo Yuden have been deeply involved in the SAW market for a long time. Among them, Murata’s global SAW share has reached 47%, and continue to launch products such as TC-SAW and IHP-SAW to meet the needs of 5G;

BAW: Broadcom Avago monopolizes 87% of the BAW filter market with its strong technical strength and patent layout, followed by Skyworks and Qorvo in the second echelon with modular supporting production.

Domestic manufacturers only have a small number of mid-to-low-end SAW layouts, and BAW filters are currently only mass-produced by a small number such as Tianjin North.

The global PA market size was USD 5.6 billion in 2019 and is expected to grow to USD 7.0 billion by 2023. Since RF devices have high requirements for design experience and technology, and PA is the front-end core device with the most complex structure, the current global market is basically monopolized by the three major RF giants in the United States. Among them, Skyworks accounted for 43%, Qorvo accounted for 25%, Broadcom accounted for 25%, and the remaining manufacturers accounted for less than 10%.

Due to the increase of antenna and filter components brought by 5G, the internal space of the terminal is reduced, which brings challenges to the multi-band design of PA. The trend of modularization contributes to volume reduction and simplification of the design process. It is estimated that the scale of PA modules will reach 10.4 billion US dollars in 2025, becoming the largest segment of the RF front-end market. (See the follow-up series of reports for details: Modularization trend of RF front-ends)

In the 2G-4G frequency band, due to the mature CMOS process and easy integration, it is widely used in terminals. However, in the high-frequency band, GaAs has outstanding cost-effectiveness and power characteristics, and the second-generation material has become the first choice for PA, antenna and other devices; at the base station, because GaN has better high-frequency characteristics, the third-generation semiconductor material is widely used in the base station. Future development The space is vast.

With the popularization of 4G technology and the advancement of 5G standards, the number of frequency bands that need to be supported in smart terminals has increased significantly, and more switches are needed to improve the ability to receive signals in more frequency bands. Since 2011, the RF switch market has grown rapidly, with a market size of US$1.9 billion in 2019, and will usher in rapid growth with the large-scale commercial use of 5G. It is expected that the market size will reach US$3.56 billion in 2023.

The leading manufacturers in the RF switch market are Skyworks and Murata, both of which are comprehensive RF device and design solution providers with strong modularization capabilities. The leader of domestic RF switches and LNA components is Zhuosheng Micro, which has started the layout of domestic front-end modules.

LNA is generally used at the receiving end to amplify the antenna signal and has the advantage of suppressing noise. At present, low-noise amplifiers are mostly used as modular components, integrated with simple components such as RF switches in LFEM, WIFI FEM, and LNA Bank modules. The market size will reach US$1.49 billion in 2019 and is expected to reach US$1.79 billion in 2023 (according to Discrete Computing)

At present, domestic manufacturers, Zhuo Shengwei and UNISOC, combined their own platform and modular integration advantages in the LNA field, leading the industry in terms of LNA shipments, but there is a big gap with international advanced manufacturers.

Introduction of the four major radio frequency giants in Japan and the United States

The RF front-end industry consists of discrete device manufacturers, module factories, complete machine brands, and platform design service providers. Among them, the upstream discrete device head manufacturers have strong comprehensive production and sales capabilities, and can carry out modular layout earlier, forming a first-mover advantage.

The global RF front-end market is highly concentrated, with the top four manufacturers Skyworks, Qorvo, Broadcom, and Murata occupying more than 90% of the market share, and are constantly expanding through integration and mergers to diversify their businesses;

In the field of power amplifiers such as PA and LNA, Skyworks occupies nearly half of the market, but is being caught up by Qorvo; in the direction of filters, Murata monopolizes 47% of the market share of SAW filters, while Broadcom occupies 87% of the filter market .

Among the four major radio frequency giants, Skyworks and Qorvo’s revenue mainly comes from front-end modules. Among the product types, Broadcom and Murata’s business involves various ICs, software, passive components, and packaging. The business scale is huge, and the revenue exceeds tens of billions of dollars.

Skyworks: Benefiting from the Chinese market, vigorously develop 5G and Internet of Things

Founded in 1962 and headquartered in Massachusetts, USA, Skyworks is committed to developing semiconductor devices for radio frequency and mobile communication systems. Benefiting from a sound product structure, expansion in the IoT and WiFi fields, and wide application in Apple mobile phones, it is also a supplier of RF components for many domestic mobile phone brands. The revenue share in China is second only to that in the United States (2019 share twenty two%). In fiscal year 2019, the company achieved a revenue of US$3.377 billion and a net profit attributable to the parent of US$860 million.

Skyworks has complete product coverage in SAW filters, RF power amplifiers, RF switches and other products, and has strong chip integration module capabilities. In 2019, it occupies 43% of the global RF PA market share and 23% of the RF switch market share.

In order to meet the challenges brought by the 5G era, Skyworks created the Sky5® platform, which simplifies the development difficulty of 5G architecture through highly integrated transmitter/receiver solutions and diversity receiver modules (DRx), and is expected to accelerate the deployment in the IoT and 5G markets in the future .

The Sky5® Ultra integrated solution uses a DSBG package to reduce size, improve the performance of TC-SAW and BAW in the target frequency band, and has leading transmission and reception capabilities. It brings reliable network connection transmission to the terminal and optimizes the battery life of the mobile phone. The Sky5® LiTE front-end solution is aimed at the mass market, supports up to 100 MHz 5G New Radio (NR) waveform bandwidth, and can be adapted to all leading chip provider interfaces.

Qorvo: The “new” army of RF communications, mergers and acquisitions promote rapid business expansion

Qorvo was established by the merger of TriQuint Semiconductor and RF Micro Devices (RFMD) in 2015. It is headquartered in North Carolina, USA. It focuses on the production of RF communications and defense products. After the merger, it has a full range of antennas, PAs, filters and RF switches. business layout. In 2019, the company achieved a revenue of US$3.229 billion and a net profit of US$334 million attributable to the parent company.

After the establishment of Qorvo, the company continued to carry out mergers and acquisitions to expand its product line, and its business layout basically covered the entire RF front-end industry chain. Among them, BAW technology has developed rapidly, occupying 8% of the global filter market share, second only to Broadcom. The company’s global market share of RF switches and LNA devices is as high as 35%, and the market share of RF PAs has also reached 25%.

Qorvo has long occupied a leading position among providers of RF products by virtue of its technical advantages and modular layout. The company acquired GaN, GaAs and SOI technology applications and antennas and RF PA devices through acquisitions, and continued to acquire RF MEMS process manufacturers such as Cavendish to further upgrade the production process of its RF front-end devices, and formed a full-service advanced layout through modular integration.

The company completed the acquisition of Custom MMIC and Decawave in 2020Q1, and further deployed low-power IoT and UWB technologies. Combined with the previous acquisition of IoT-related technologies, it has formed more influence in the fields of IoT and 5G.

Broadcom: The fifth largest semiconductor manufacturer with strong RF business

Broadcom Limited, which was renamed after Avago acquired Broadcom for US$37 billion in 2016, is currently headquartered in the United States and Singapore, and its main business is semiconductor business and software business. In 2019, it achieved revenue of US$22.597 billion and a net profit of US$3.46 billion attributable to the parent company. It is the fifth largest semiconductor company in the world, and its RF business accounts for about 30%.

Broadcom provides wireless embedded solutions and RF component products, including a complete line of RF front-end products. The company has a long history in the RF front-end field, and has strong strength in filters (BAW) and front-end modules, monopolizing 87% of the global BAW filter market.

Broadcom-Avago has continuously expanded its business scope and deepened its technology moat through the merger and acquisition of a number of semiconductor and communication companies. At present, the company’s strategic development direction is gradually adjusted to software, but the semiconductor and radio frequency business is still widely recognized by users around the world, contributing more than 30% of the company’s revenue.

Murata: The leader of Japanese old-fashioned electronic devices, with a diverse and comprehensive patent layout

Murata (Murata) was established in 1944 and is headquartered in Kyoto, Japan. Its main products are the design and manufacture of advanced electronic components, multi-functional communication modules, and power ICs. Acquired Peregrine Semiconductor in August 2014 to expand RF front-end business. In 2019, it achieved revenue of US$14.191 billion and a net profit of US$1.693 billion attributable to the parent company, of which overseas revenue accounted for more than 90%. It is Japan’s largest manufacturer of electronic components.

Murata is the world’s leading supplier of electronic components, with strong strength in passive components, href=”https://www.yibeiic.com/”>connector technology and MEMS technology. In terms of radio frequency, the company provides components and modular products including filters and radio frequency switches, occupying a 47% market share in the global SAW filter market.

Intellectual property rights and patent layout are important development strategies for Murata. The company focuses on the independent development of new products and technologies, and has unsurpassable advantages in the field of radio frequency products, especially SAW technology. In 2018, the company had 8,121 patent applications in Japan and 12,474 patent applications worldwide, ranking 29th globally in the number of applications.

Relying on a comprehensive patent layout and excellent supply chain management capabilities, the company provides various electronic components to customers around the world, occupying a relatively high market share. Among them, ceramic capacitors accounted for 40% of the global market, SAW filters accounted for 50% of the world, and electromagnetic shielding components EMI accounted for 35% of the world. The communication connector module share is more than 55%, and the market share is the first in the world.